ad valorem tax florida real estate

Ad valorem means based on value. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Property Taxes Brevard County Tax Collector

Real estate taxes comprise ad valorem taxes and non-ad valorem assessments while personal property taxes are solely ad valorem.

. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. They determine the ownership mailing address legal description and value of the.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. Save Time Signing Documents from Any Device.

Florida ad valorem valuation and tax data book. The most common ad valorem taxes are property taxes levied on. These tax statements are mailed out on or before.

The greater the value the higher the assessment. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. In cases where the property.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. Ad valorem taxes are based on the value of. It includes land building fixtures and improvements to the land.

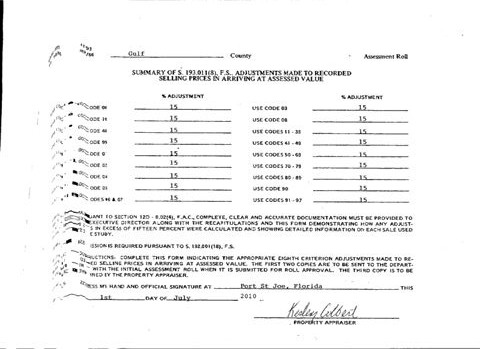

By email or visit one of our offices. Authorized by Florida Statute 1961995. The Property Appraiser establishes the taxable.

The Ad Valorem tax roll consists of real estate taxes and tangible personal property taxes. Tax bills are mailed on or around November 1 each year. If any tax statements are missing please contact the Office of Will Roberts Tax Collector.

The total of these two taxes equals your annual property tax amount. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages. PDF 125 KB Individual and Family Exemptions Taxpayer Guides.

Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. The ad valorem tax roll consists of. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

By phone at 386-736-5938. The Real Estate and Tangible Personal Property tax rolls are prepared by the Property Appraisers office. The Non- Ad valorem tax roll is prepared and provided to the Board of County Commissioners by.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Sales and Use Tax. Real property is located in described geographic areas designated as parcels.

Annual property tax bills are.

Florida Dept Of Revenue Property Tax Data Portal

Property Tax Search Taxsys Broward County Records Taxes Treasury Div

2022 Property Taxes By State Report Propertyshark

Florida Dept Of Revenue Taxpayers

Florida Real Estate Taxes And Their Implications

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Florida Property Tax H R Block

Real Estate Property Tax Constitutional Tax Collector

How Taxes On Property Owned In Another State Work For 2022

Florida Real Estate Taxes What You Need To Know

Secured Property Taxes Treasurer Tax Collector

What Is A Homestead Exemption And How Does It Work Lendingtree

:max_bytes(150000):strip_icc()/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)